2024 Fsa Rollover Limit

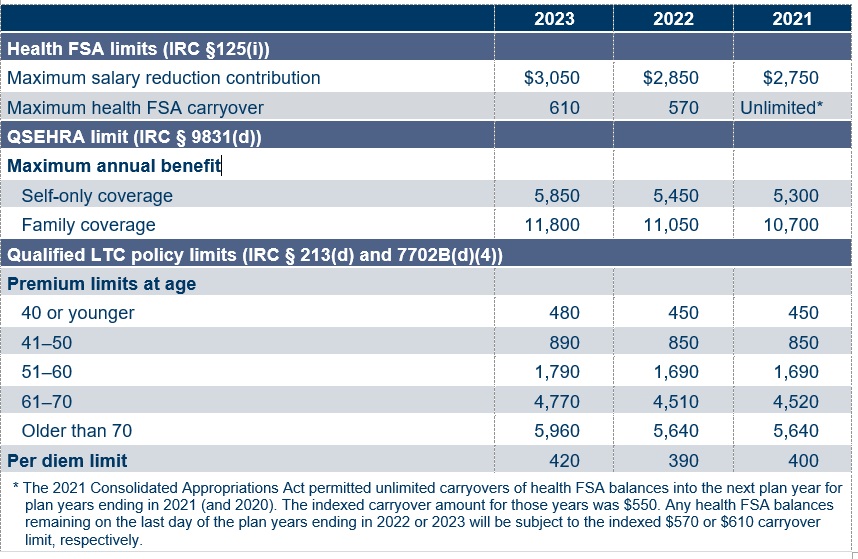

2024 Fsa Rollover Limit. For unused amounts in 2023, the maximum amount that can be carried over to 2024 is $610. This means that if you have money left in your fsa at the end of the plan year in 2024, for any reason, you can keep.

For unused amounts in 2023, the maximum amount that can be carried over to 2024 is $610. Retirement, fsa, hsa, and commuter benefits.

In 2024, You Can Carry Over Up To $640 (Up From $610 In 2023).

Fsas only have one limit for individual and family health.

Download A Printable Pdf Highlights Version Of.

Employees participating in an fsa can contribute up to $3,200 during the 2024 plan year, reflecting a $150 increase over the 2023 limits.

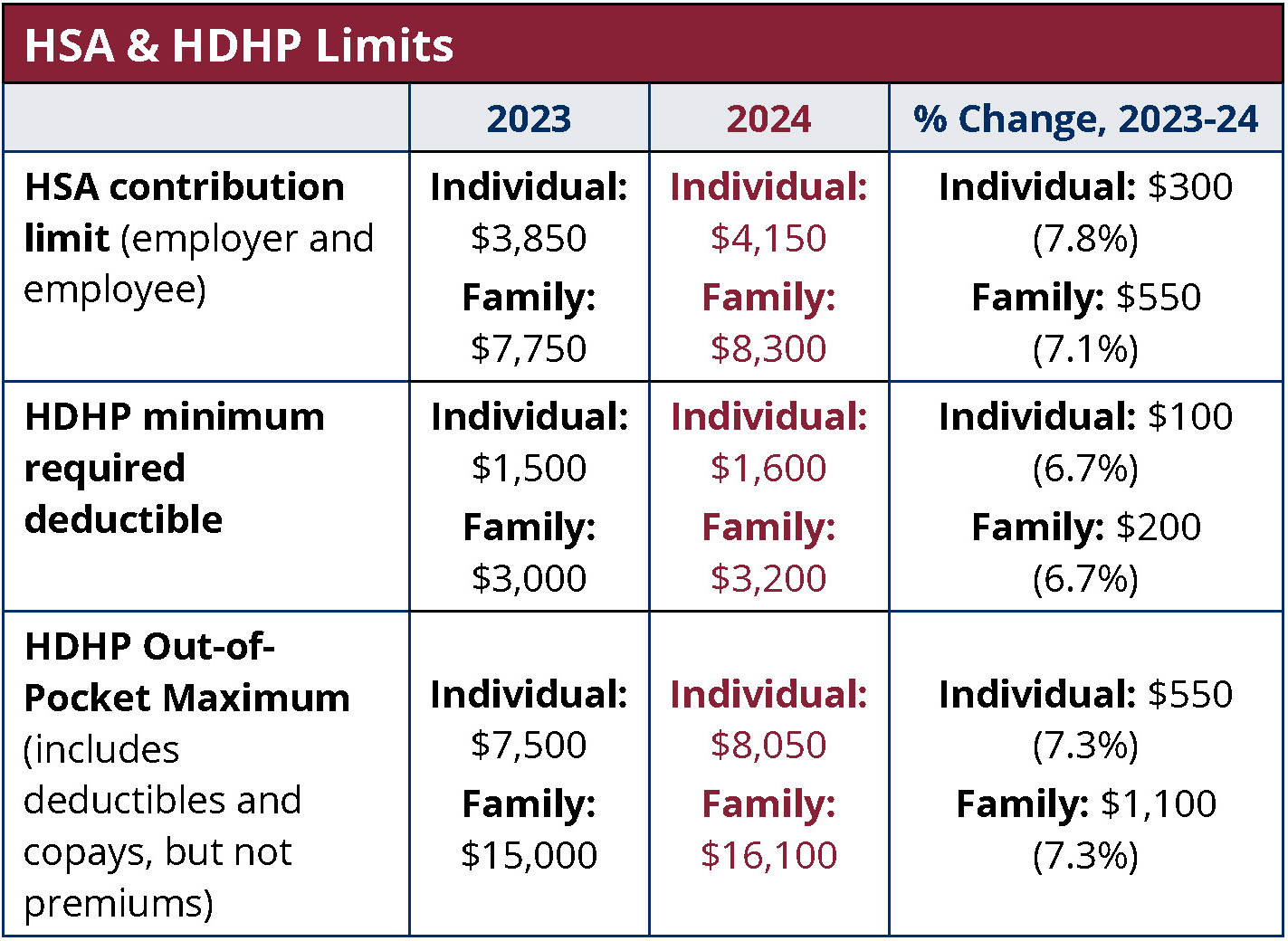

Here Are The New 2024 Limits Compared To 2023:

Employers may also contribute, but specific rules limit the total amount.

Images References :

Source: x2023cq.blogspot.com

Source: x2023cq.blogspot.com

How Much Fsa Can I Roll Over To 2023 X2023C, It's important for taxpayers to annually review their. Here are the new 2024 limits compared to 2023:

Source: www.wexinc.com

Source: www.wexinc.com

2023 FSA limits, commuter limits, and more are now available WEX Inc., Employees can now contribute $150 more. Health fsa contribution and carryover for 2022.

Source: holapty.com

Source: holapty.com

Dependent Care Fsa Rollover Tricheenlight, Fsas only have one limit for individual and family health. 29 november 2023 extensishr 6 minute read.

![2023 IRS Limits for HSA, FSA, 401k, HDHP, and More Guide]](https://www.griffinbenefits.com/hs-fs/hubfs/2023 IRS FSA Limits.jpg?width=5765&height=1350&name=2023 IRS FSA Limits.jpg) Source: www.griffinbenefits.com

Source: www.griffinbenefits.com

2023 IRS Limits for HSA, FSA, 401k, HDHP, and More Guide], 1, 2024, the contribution limit for health fsas will increase another $150 to $3,200. For fsas that permit the carryover of unused amounts, the maximum 2024 carryover amount to 2025 is $640.

Source: www.hrmorning.com

Source: www.hrmorning.com

New 2024 FSA and HSA limits What HR needs to know HRMorning, 2024 flexible spending account (fsa) rules, limits & expenses. The irs set a maximum fsa contribution limit for 2024 at $3,200 per qualified fsa ($150 more than the prior year).

Source: www.firstdollar.com

Source: www.firstdollar.com

IRS Makes Historical Increase to 2024 HSA Contribution Limits First, For fsas that permit the carryover of unused amounts, the maximum 2024 carryover amount to 2025 is $640. For cafeteria plans that allow the carryover of unused amounts, the maximum carryover amount for 2024 is.

Source: www.mercer.com

Source: www.mercer.com

2023 health FSA, other health and fringe benefit limits now set Mercer, Retirement, fsa, hsa, and commuter benefits. Employers can generally allow employees to transfer a.

Source: admin.itprice.com

Source: admin.itprice.com

Fsa 2023 Contribution Limits 2023 Calendar, For cafeteria plans that allow the carryover of unused amounts, the maximum carryover amount for 2024 is. 2024 benefit plan limits & thresholds chart.

Source: www.medben.com

Source: www.medben.com

2024 HSA Contribution Limit Jumps Nearly 8 MedBen, An fsa contribution limit is the maximum amount you can set. Qualified transportation and health fsa limits.

Source: www.wpdcpa.com

Source: www.wpdcpa.com

2024 FSA Contribution Limit Increases Wallace, Plese + Dreher, For cafeteria plans that allow the carryover of unused amounts, the maximum carryover amount for 2024 is. 2024 health savings account (hsa) limits.

Health Fsa Contribution And Carryover For 2022.

The maximum amount you can contribute to an fsa in 2023 is $3,050 for each qualified account.

Employees Participating In An Fsa Can Contribute Up To $3,200 During The 2024 Plan Year, Reflecting A $150 Increase Over The 2023 Limits.

If you don’t use all your fsa funds by the end of the plan year, you may be able to carry over $640.

Here Are The New 2024 Limits Compared To 2023:

Fsas only have one limit for individual and family health.

Posted in 2024